A bank statement is a document that lists all transactions that have occurred through a particular bank account within a given period. These transactions include deposits, withdrawals, fees charged, expenses and interest earned. Bank statements are typically issued recurrently (monthly, quarterly, yearly) and can be accessed both in paper form and digitally via online banking platforms. Most modern banks allow customers to access their statements via an online portal and download it as a digital file.

Anatomy of a bank statement

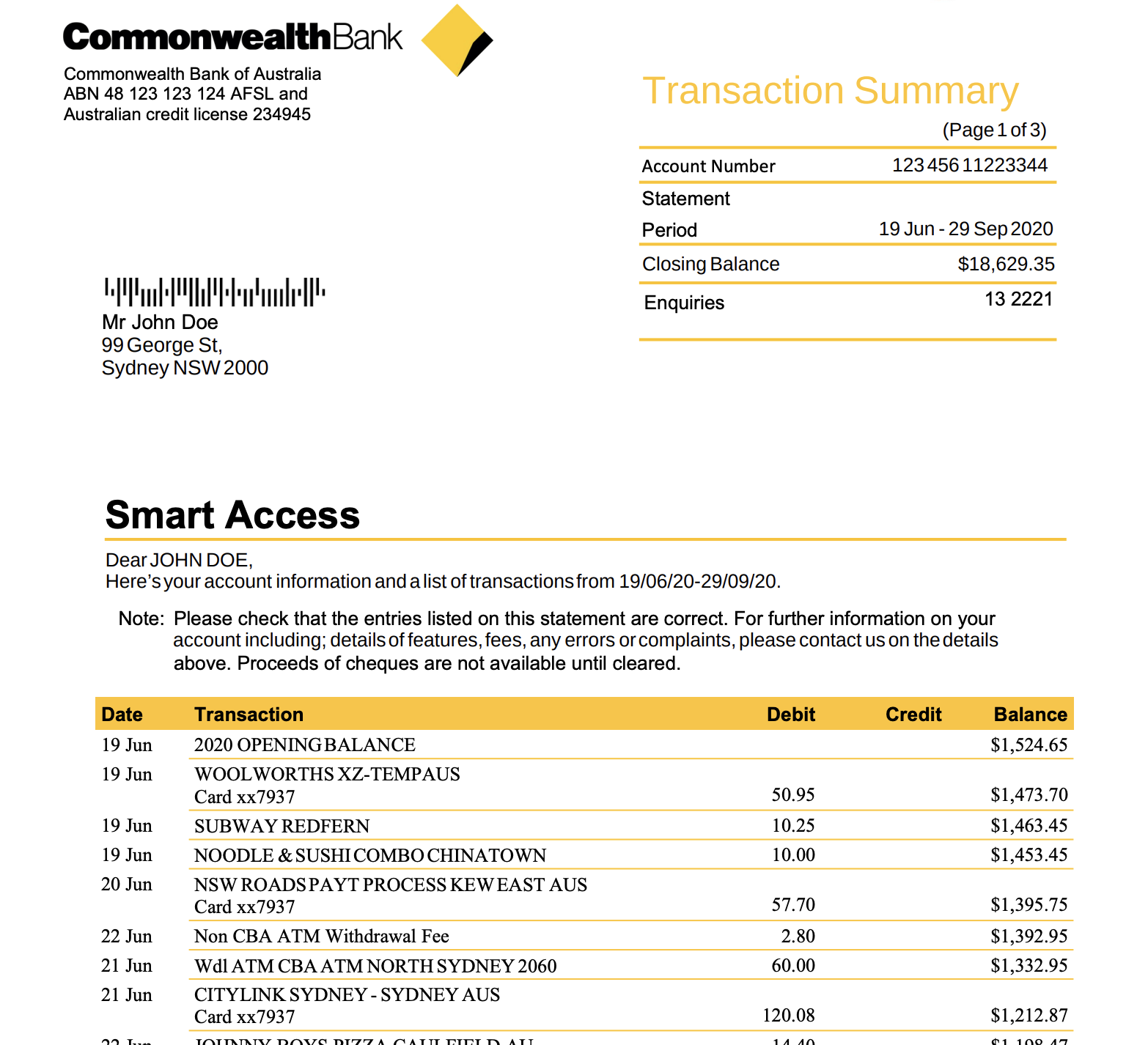

A typical bank statement consists of customer details and a list of transactions that occurred in the specified period. Some of the most common information available in a bank statement are:

- Account Details - Details about the account holder such as customer name, address, account number and account type.

- Period - The start and end period of the statement.

- Opening and Closing Balance - The total balance at the starting date and ending date.

- Bank Name - Name of the bank

- List of Transactions - A list of all the transactions occurred in that period. Each transaction consists of things like date, description, transaction type (debit / credit), transaction amount and total remaining balance.

Here is an example of a bank statement from Commonwealth Bank of Australia with detailed information about the customer and list of transactions made during the period of 19 June 2020 to 29 September 2020.

Paper vs Electronic bank statement

Traditionally, bank statements were printed on paper and provided to customers. Even to this day, bank statements are available in paper and are delivered to customers via mail or made available to them at the bank. On the other hand, electronic bank statements can be accessed from an online portal and can be downloaded. While some banks offer CSV download, PDF is the most common format for electronic statements.

As computers became mainstream, electronic bank statements have more or less replaced paper based statements because of the convenience and not having to worry about keeping it safe somewhere. People with basic knowledge of the internet and computers can download their statement easily. However, this hasn't completely replaced paper statements which are still widely used. In the future though, we will likely see the rise of electronic statements and paper statements may not be available at all.

Application of Bank Statement

Bank statement is one of your most important financial documents and has a lot of use cases in your day to day life.

- Financial Planning: Analyzing your transactions can help you plan your future expenses and manage your finances.

- Tax Preparation: Bank statement is a vital document when it comes to reporting your income and expenses while filing your tax.

- Loan Application: Bank statements are often required by lenders to assess the financial health of applicants.

- Fraud Detection: Carefully monitoring your bank statement can help you identify any unauthorized transactions.

Conclusion

Understanding a bank statement is fundamental for effective financial management. Whether you're a personal account holder or a business owner, regularly reviewing your bank statement can help you maintain control over your finances, ensure accuracy, and plan future financial activities effectively.