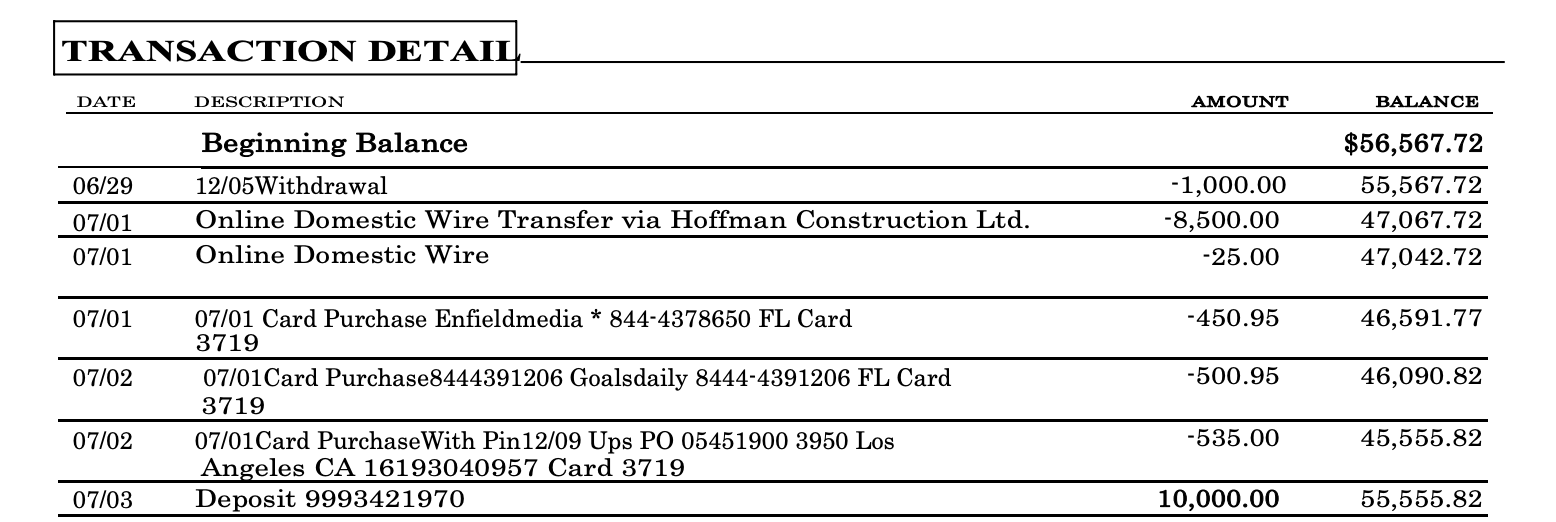

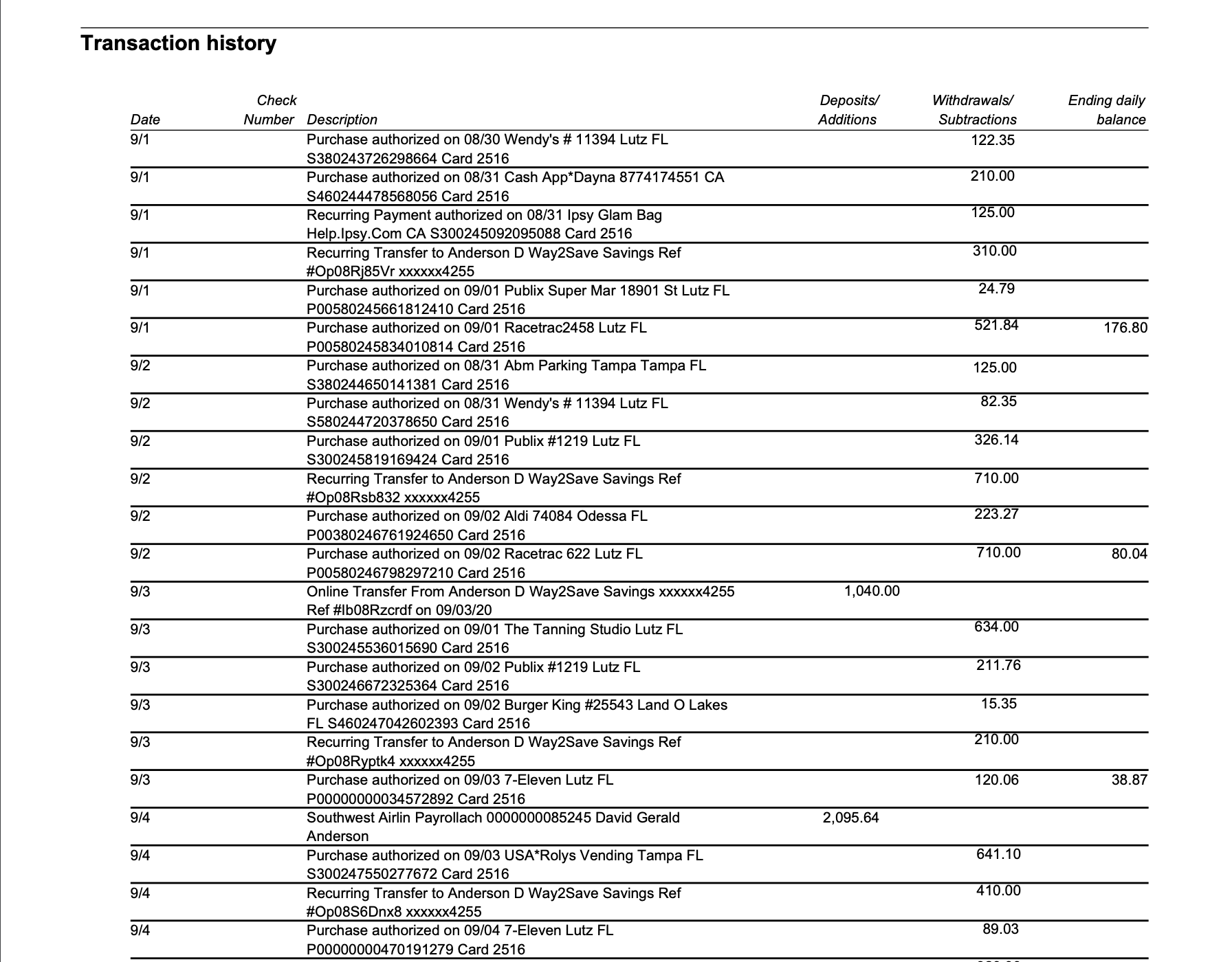

Bank statement is a document provided by your bank that has all the information about your day to day financial transactions. Whether you are paying for coffee, buying clothes or receiving any payments like salary, your bank statement will have a record of it. Generally a bank statement consists of the date of transaction, description, debit or credit amount and the remaining balance in your account.

If you have ever tried copying transactions from your pdf bank statements to an excel or CSV file, you probably know how tedious and time-consuming the process is. It requires a lot of manual effort and there is no margin for error given the sensitiveness of the document. Further, you probably have to go through the output file at least once to make sure there are no mistakes.

Whether you are running a small business or just want to go through your personal finances, a bank statement is one of the most important documents that you need. You will need your bank statement while filing your tax returns, generating reports or applying for a loan. To address this problem, you can either develop your own solution or use an existing service. Since not everyone is familiar with the technical stuff, we have developed a software solution, Import Bank Statement that can go through any bank statement and extract transaction information into a CSV file.

How does "Import Bank Statement" work?

Import Bank Statement reads through a given pdf bank statement, analyzes its structure and parses it accordingly to convert it into rows and columns of data. The parser is aware of the fact that each bank statement has a header row followed by lines of transaction. Using this knowledge, it first finds the header and the boundary of each column (date, transaction, debit, credit, balance). Then, from the next line, it matches specific patterns for each field and copies them into respective cells.

The algorithm is intelligent enough to find which line is a valid transaction and which is not based on the presence of dates, numbers and words. It is also capable of detecting transactions spanning multiple lines because of a longer description.

Once all the valid transactions are processed, it is able to detect the end of the transaction for that particular page and move on to the next page for processing. While it seems straightforward for humans to understand the structure by looking at the document, it is not the same for softwares. A lot of internal validations are done to make sure the data is correct.

Using Import Bank Statement

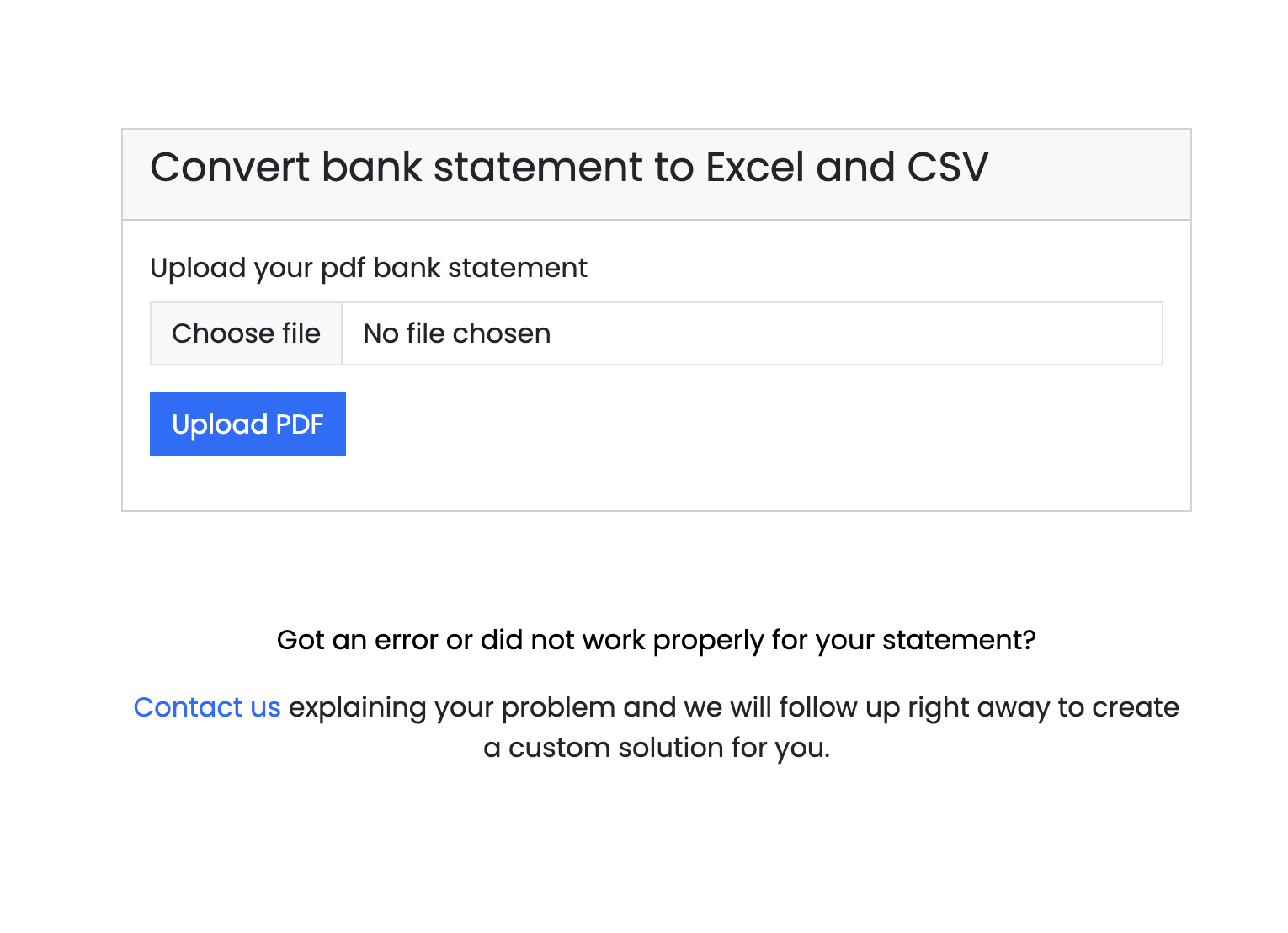

Import Bank Statement is designed in a way that anyone who has been on the internet can use it easily. The interface is clear and provides a button to upload and process a bank statement. In order to get started, you will need to follow the following steps:

- Create a free account if you haven't already by going to the registration page.

- Once the account is created, wait for a confirmation link in your email and click that link to confirm your account. Check spam if you didn't receive it in your inbox.

- Proceed to login with your email address and password.

- You will see a page where you will be able to upload your bank statement.

- Click on "Choose file", select the statement from your computer and press "Upload PDF". Below is a screenshot of how the transactions look like in the PDF statement.

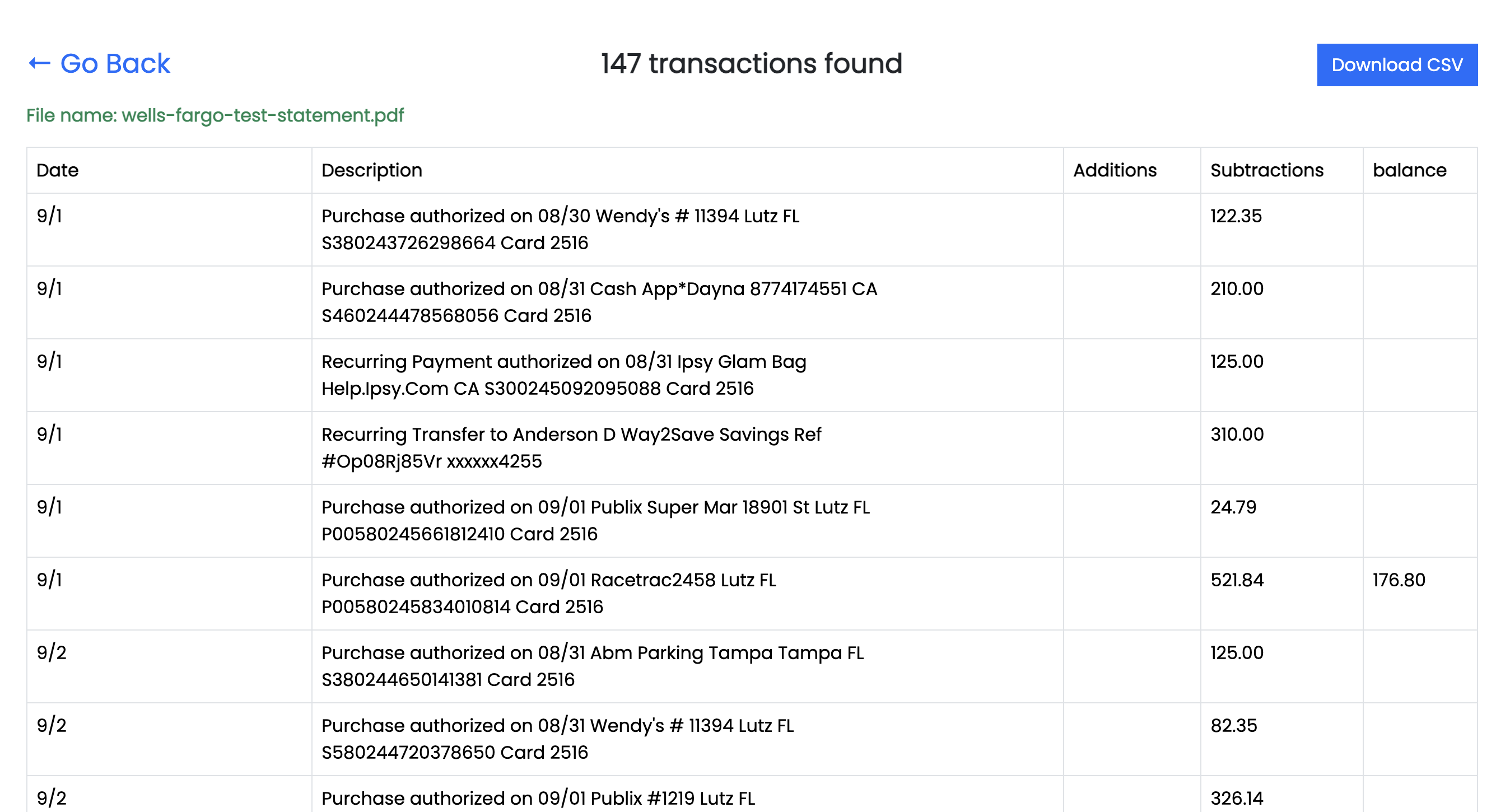

- After a few seconds, you will be redirected to a page where you can see the processed transaction.

- Review the transaction with the uploaded file and click on "Download CSV" to get it in CSV format. You can them open it in MS-Excel and perform further analysis.

Once you have downloaded the CSV file, you can open it in excel and analyze your transactions as per your need.

Use cases for Import Bank Statement

There are a lot of use cases for a product like "Import Bank Statement". Bank transactions are an integral part of modern financial systems. Some of the use cases are listed below:

- Personal Finance Management: The processed data can be used to keep track of income (salary, bonus) and expenses (rent, monthly subscriptions, travel cost) and plan ahead for the future.

- Bookkeeping: Small businesses can streamline the entry of transaction data into accounting software, reducing manual bookkeeping efforts and improving accuracy.

- Audit Preparation: Companies can prepare for audits more efficiently by having their bank transactions neatly organized and readily accessible in Excel or CSV formats.

- Mortgage and Loan Application: Lenders can process loan applications faster by quickly reviewing applicants' financial histories in a structured format.

- Visa Processing: Bank statements are required in certain cases while processing visas to show the proof of balance and income.

A service like "Import Bank Statement" can help you save a lot of time that would have been wasted doing tedious copy-paste from PDF to Excel. We do not claim to be 100% correct and you are still responsible for doing due diligence on your side to make sure the processed data is error free. But it does help you speed up the overall process from doing everything on your own to simply reviewing the output.

If you have any questions about our product, feel free contact us via email or filling the contact form.